Faith and Hope are 30-year-old identical twins. The only difference between them is their credit score. Faith has a proven record of repaying debts. Faith can borrow money at 4.5 percent. Hope has often missed debt payments. Hope can borrow at 8.5 percent.They are considering enrolling in an evening MBA program. They plan on completing the program in two years. Assume the annual tuition is $16,000 for both years. They also anticipate that the nonmonetary costs of obtaining an MBA will be $40,000 per year. The twins anticipate that after graduation in two years, their earnings will be $10,000 per year higher until they retire at age 62. Should Faith enroll in the evening MBA program? Should Hope enroll in the evening MBA program?

What will be an ideal response?

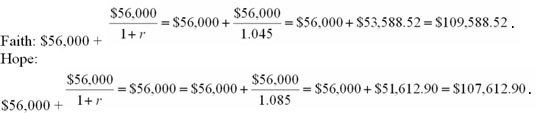

This problem requires us to compare the costs and benefits of the decision using discounted present value. The cost of the MBA measured in today's dollars is

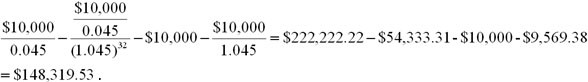

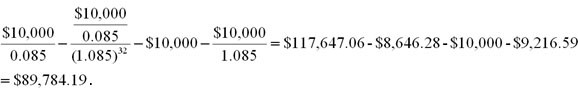

The benefits are a stream of higher benefits starting in 2 years and lasting 30 years until retirement at age 62. An infinite stream of $10,000 forever starting now - an infinite stream of $10,000 forever starting in 32 years - $10,000 -  .

.

PDV= ![]() .

.

Faith:

Hope:

Given these figures, Faith should enroll in the MBA program because the benefits measured in today's dollars are greater than the costs measured in today's dollars. Hope should not enroll as the costs exceed the benefits.

You might also like to view...

The Open Market Trading Desk is

A) another name for the Federal Open Market Committee. B) an organization of private traders in government securities. C) the area on the floor of the New York Stock Exchange set aside for bond trading. D) a group of private securities traders that the Fed has selected to participate in open market operations.

If a negative income tax system were implemented, then the poor would have no incentive to find work

a. True b. False Indicate whether the statement is true or false

Fixed costs are best defined as

a. costs that do not vary with output. b. costs that are at a minimum when output approaches the firm's capacity. c. the amount that one more unit of output adds to total costs. d. costs that decline as output increases.

As economies are predictable, economic risk presents executives with very few challenges.

Indicate whether the statement is true or false.