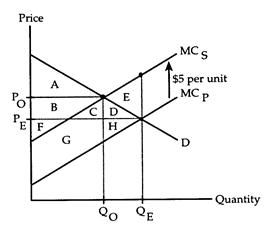

Refer to Negative Externality. Suppose there is no attempt to internalize the externality. Pigovian analysis indicates that the externality creates a deadweight loss equal to

The following questions refer to the accompanying diagram, which shows the effects of a negative externality created by an industry's production. The equilibrium quantity in the absence of any attempt to internalize the externality is QE, and the optimal quantity according to a Pigovian analysis is QO.

a. area C + D + E + G + H.

b. area D + E + H.

c. area C + D + G + H.

d. area E.

d. area E.

You might also like to view...

From 1900 to 2013, real GDP per person has had two important attributes

A) It has grown substantially over time and there are small differences from country to country. B) It has grown unevenly over time in the U.S. but it has grown substantially. C) It has grown evenly over time in the U.S. and there are huge differences from country to country. D) It has fluctuated around a trend in the U.S. but it has not grown much for all the Southeast Asian countries. E) It has doubled in the U.S. but there have been many recession periods.

All the problems studied in economics arise from

a. the unequal distribution of income b. overpopulation c. the scarcity of resources d. inappropriate government action e. war

When a firm does more of something, it gets better at it. This learning-by-doing is:

A. called the principle of natural progression. B. a source of diseconomies of scale. C. a source of economies of scale. D. called "spreading the overhead."

Exhibit 4-1 Supply and demand data Price Quantitydemanded Quantitysupplied $1.00 500 50 1.50 450 150 2.00 400 250 2.50 300 300 3.00 150 350 In Exhibit 4-1, suppose that a reduction in the price of an important input used to produce the good causes an increase in quantity supplied of 150 units at every price level. Assuming that demand does not change, the new equilibrium price will be:

A. $1.00. B. $1.50. C. $2.00. D. $2.50.