Under indirect method, depreciation is added back to net profit when arriving at the cash flow from operating activities because:

a. depreciation is an estimated amount.

b. depreciation is a noncash expenditure.

c. depreciation is not considered for calculation of taxable income.

d. is added to the net income to arrive at net cash provided by operating activities.

b

You might also like to view...

Armac Ltd. is a sluice-box manufacturer based in China. A sluice-box is used for gold prospecting

Armac is interested in selling a few of its machines to an American mining company, but it wants 95 percent of the machines' price in gold and the rest in ores recovered by using the machines. This is an example of a ________. A) buyback arrangement B) functional discount C) barter deal D) compensation deal E) sealed bid

Under accrual accounting, revenue is recognized when

a. the firm has performed all, or most of, the services it expects to provide. b. the firm has received cash, or some other asset such as a receivable, whose cash-equivalent value it can measure with reasonable precision. c. the firm has significant uncertainty about the amount and timing of the cash inflows and outflows from the sales transaction. d. both a and b must be present. e. none of the above.

Angela's gross pay for the week is $970

00. Her deduction for federal income tax is based on a rate of 20%. She has voluntary deductions of $220.00. Her yearly pay is under the limit for OASDI. What is the amount of FICA-Medicare Tax deducted from her pay? (Assume a FICA-OASDI Tax of 6.2% and FICA-Medicare Tax of 1.45%.) A) $194.00 B) $14.07 C) $60.14 D) $268.21

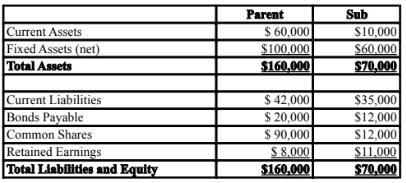

The Shareholders' Equity section of the Consolidated Balance Sheet would show what amount?

Parent and Sub Inc. had the following balance sheets on December 31, 2018:

On January 1, 2019 Parent purchased all of Sub Inc.'s Common Shares for $40,000 in

cash. On that date, Sub's Current Assets and Fixed Assets were worth $26,000 and

$54,000, respectively. Assuming that Consolidated Financial Statements were prepared

on that date, answer the following:

A) $98,000 B) $19,000 C) $90,000 D) $121,000