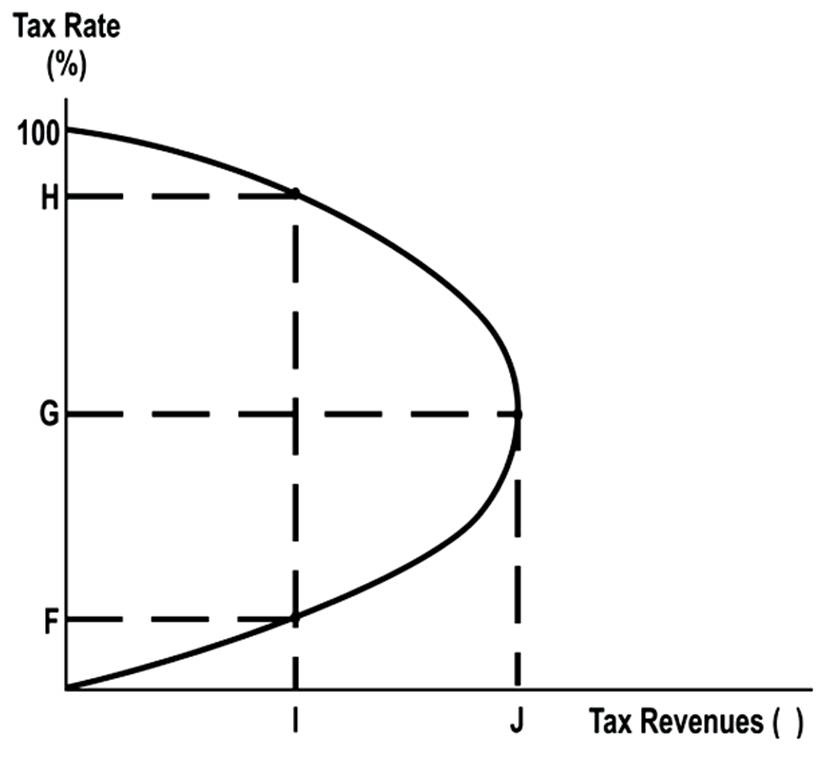

Which tax rates result in zero tax revenue?

A. F and G

B. G and H

C. F and H

D. 0 and 100%

D. 0 and 100%

You might also like to view...

The contribution of ________ to federal tax receipts is larger than the contribution of ________

A) personal income taxes; corporate income taxes B) corporate income taxes; payroll taxes C) corporate income taxes; personal income taxes D) excise taxes; social insurance taxes

If demand is inelastic, an increase in the price will

A) decrease total revenue. B) increase total revenue. C) not change total revenue. D) increase the quantity demanded.

The LRAC curve

A) is the minimum points on all the short-run ATC curves. B) shows the lowest possible marginal cost of producing the different levels of output. C) shows the lowest attainable average total cost for all levels of output when all inputs can be varied. D) generally lies above the short-run ATC curves.

Which of the following most accurately describes the type of mergers that the antitrust laws are intended to prohibit?

a. mergers that tend to reduce competition b. horizontal mergers c. both vertical and horizontal mergers d. conglomerate mergers e. vertical mergers