A $1,000 face value bond purchased for $965.00, with an annual coupon of $60, and 20 years to maturity has a:

A. A yield to maturity and current yield equal to 6.00%.

B. current yield equal to 6.22% and a coupon rate below this.

C. current yield and coupon rate equal to 6.22% and a coupon rate above this.

D. coupon rate equal to 6.00% and a current yield below this.

Answer: B

You might also like to view...

Refer to Table 11-2. Calculate the GDP per capita for each country in the table. Which country has the highest standard of living? Why?

What will be an ideal response?

Proponents of inward-oriented policies ignore the fact that natural resources are exhaustible, so their long-run market value will fall

a. True b. False Indicate whether the statement is true or false

Shontae wants to start a pet hotel and is thinking of setting it up as a partnership with her sister Victoria. What are the advantages and disadvantages she will face by setting up the business as a partnership as opposed to a sole proprietorship or a

corporation? What will be an ideal response?

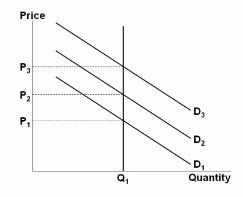

Refer to the figure. Assuming this market is representative of the economy as a whole, this economy:

A. is highly susceptible to inflation.

B. faces fluctuating output levels whenever there is a demand shock.

C. is capable of always producing at its optimal capacity.

D. is largely immune to business cycles.