Suppose a government that taxed all interest income changed its tax law so that the first $5,000 of a taxpayer's interest income was tax free. This would shift the

a. supply of loanable funds to the right, causing interest rates to fall.

b. supply of loanable funds to the left, causing interest rates to rise.

c. demand for loanable funds to the right, causing interest rates to rise.

d. demand for loanable funds to the left, causing interest rates to fall.

a

You might also like to view...

A monopolist's total profit is shown by the difference between price and average cost per unit times the number of units sold

a. True b. False Indicate whether the statement is true or false

If the Lorenz Curve were used to graph the distribution of income in an economy where all households earn the exact same income, the graph would show a _____.

(A) Curved line and sloped diagonally upward. (B) Straight line and sloped diagonally upward. (C) Curved line and sloped diagonally downward. (D) Straight line and sloped diagonally downward.

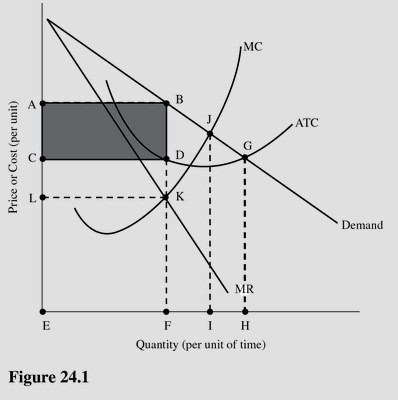

The shaded area in Figure 24.1 represents

The shaded area in Figure 24.1 represents

A. Total cost. B. Total loss. C. Total revenue. D. Total profit.

The crowding-out effect is

A. the tendency of contractionary fiscal policy to cause an increase in planned investment but a decrease in planned consumption in the private sector. B. the tendency of expansionary fiscal policy to cause a decrease in planned investment or planned consumption in the private sector. C. the tendency of expansionary fiscal policy to cause an increase in planned investment but not in planned consumption in the private sector. D. the tendency of contractionary fiscal policy to cause an increase in planned investment or planned consumption in the private sector.