A local government currently has a tax base of $4 billion and a tax rate of 5 percent. If the tax rate is increased to 6 percent, the tax base will decrease to $3.5 billion. If the goal is to maximize tax revenues the tax rate should be

A) lowered below 5 percent.

B) kept at 5 percent.

C) raised to 6 percent.

D) abolished.

C

You might also like to view...

The self-correcting tendency of the economy means that falling inflation eventually eliminates:

A. exogenous spending. B. recessionary gaps. C. expansionary gaps. D. unemployment.

Which of the following is true? a. Consumption of a public good by one individual reduces the availability of the good for others. b. It is extremely difficult to limit the benefits of a public good to the people who pay for it

c. Public goods are free whenever the government produces them. d. From an efficiency standpoint, a market economy will generally supply too much of a public good.

The pattern of protection in industrial countries is particularly harmful to the interests of

A) low-income developing countries. B) high-income industrial countries. C) Asian nations. D) European nations.

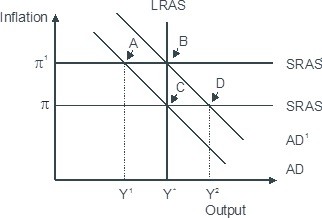

Based on the figure below. Starting from long-run equilibrium at point C, an increase in government spending that increases aggregate demand from AD to AD1 will lead to a short-run equilibrium at point ________ creating _____gap.

A. D; an expansionary B. B; no output C. B; expansionary D. A; a recessionary