Ralph is single and reports the following items for 2019:

Nonbusiness capital gains$ 9,000

Nonbusiness capital losses(3,000)

Interest income6,000

Itemized deductions (none of the amount resulted from a casualty loss)(10,000)

?

In calculating Ralph’s net operating loss and with respect to these amounts only, what amount must be added back to taxable income (loss)?

A. $0

B. $200

C. $2,000

D. $3,000

E. None of these.

Answer: B

You might also like to view...

Leaders with a strong desire to engage cross-culturally anticipate and experience ______ in unfamiliar cultural environments.

a. fear b. joy and excitement c. anxiety d. success

Explain the citation in a case brief

What will be an ideal response?

What test is used to determine whether a worker is an employee or an independent contractor?

a. The Economic Realities Test b. The Right to Control Test c. The Common Law Test d. Each agency or entity having an interest in the question uses a different test e. None of these

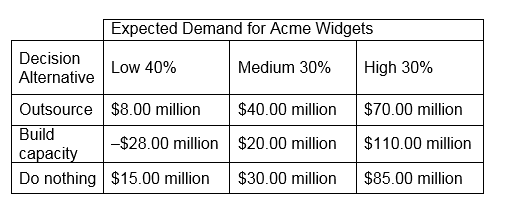

Refer to the data on Expected Demand for Acme Widgets. For the various demand scenarios and their associated probabilities, the option to do nothing has an expected value of ______.

A. $21.52 million

B. $40.50 million

C. $34.22 million

D. $65.58 million