Under a floating exchange-rate regime with a low degree of capital mobility, an expansionary fiscal policy will most likely create pressure on

A. the central bank to expand the money supply.

B. the government to impose capital controls.

C. foreign central banks to expand their money supplies.

D. the domestic currency to depreciate.

Answer: D

You might also like to view...

Suppose a Chinese restaurant provides free tea to its customers. In the economic way of thinking, the restaurant is

A) engaging in predatory pricing of its meals. B) engaging in predatory pricing of tea. C) selling Chinese food below cost. D) doing all of the above. E) almost certainly doing none of the above.

Refer to Table 9-3. If the required reserve ratio is 10%, what is the amount of excess reserves held by Alpha-Beta Bank?

A) $25 million B) $40 million C) $60 million D) $75 million

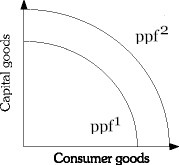

Refer to the information provided in Figure 2.6 below to answer the question(s) that follow. Figure 2.6Refer to Figure 2.6. Which of the following will shift an economy's production possibility frontier from ppf1 to ppf2?

Figure 2.6Refer to Figure 2.6. Which of the following will shift an economy's production possibility frontier from ppf1 to ppf2?

A. an increase in the economy's capital stock B. an increase in production efficiency C. a change in consumers' tastes D. a decrease in unemployment

The aggregate demand curve would shift to the left if

A) government spending were increased. B) net taxes were increased. C) the money supply were increased. D) the cost of energy were to decrease.