Find the Social Security tax (6.2%), Medicare tax (1.45%), and state disability insurance deduction (1%) for the employee. Assume the employee is under the FICA and SDI maximums at the end of the current pay period and assume that  is paid for any overtime in a

is paid for any overtime in a  week. Round to the nearest cent if needed. Hours Reg FICA Medicare SDIEmployee Worked Rate Tax Tax TaxLodge, T. 43.7 $6.80

week. Round to the nearest cent if needed. Hours Reg FICA Medicare SDIEmployee Worked Rate Tax Tax TaxLodge, T. 43.7 $6.80

A. $19.20, $4.49, $3.10

B. $16.86, $3.94, $2.72

C. $18.42, $4.31, $2.97

D. $27.64, $6.46, $4.46

Answer: A

You might also like to view...

Solve the rational inequality. Express the solution using interval notation. ? 0

? 0

A. [-1, 5] ? [8, ?) B. [-1, 5) ? (8, ?) C. (-?, -1] ? (5, 8) D. (-?, -1] ? [5, 8]

Solve the equation and check the solution.-5(-5x + 2) + 2(-8 - 8x) = 28 + 10x

A. x = -26 B. x = -22 C. x = -54 D. x = 2

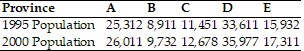

Determine whether the specified paradox occurs.In a small country consisting of 5 provinces, 300 federal judges are apportioned according to the population of each province. The population of each province is shown for the years 1995 and 2000.  Does the population paradox occur using Hamilton's method of apportionment?

Does the population paradox occur using Hamilton's method of apportionment?

A. Yes B. No

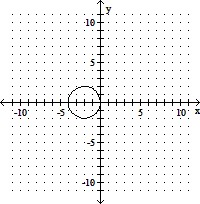

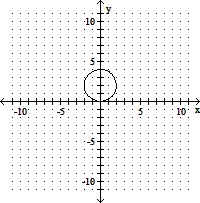

Sketch the graph of the equation. If the graph is a parabola, find its vertex. If the graph is a circle, find its center and radius.y2 + x2 - 4x = 0

A. center (-2, -0); radius = 2

B. center (0, 2); radius = 2

C. center (2, 0); radius = 2

D. center (-0, -2); radius = 2