Maximum Feasible Hourly Production Rates (in Tons) of EitherKnives or Forks Using All Available ResourcesProductCountry AlphaCountry BetaKnives93Forks612Use the above table. Assuming constant opportunity costs, the opportunity cost of producing knives in country Alpha is ________, and the opportunity cost of producing knives in country Beta is ________.

A. 2 forks; 0.33 knife

B. 0.67 fork; 4 forks

C. 1.5 forks; 0.25 fork

D. 0.5 knife; 3 forks

Answer: B

You might also like to view...

The working-age population can be divided into two groups

A) people in the labor force and people looking for work. B) people in the labor force and people with a job. C) people looking for work and those in the armed forces. D) people in the labor force and people who are not in the labor force.

In the three-step method, how do you find market price?

a. at q* go directly up to the demand curve and then go left to the vertical axis b. at q* go directly up to the supply curve and then go left to the vertical axis c. at q* go directly up to the demand curve and then go right to the equilibrium point d. at q* go directly up to the supply curve and then go right to the equilibrium point

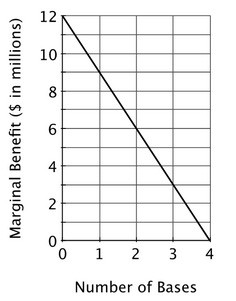

There are ten states in the democratic nation of Katlandia, and each state has ten thousand residents. Although incomes vary, each Katlandian pays a tax equal to the total cost of all government projects divided by the number of residents in the country. Currently, two states each have one army base. An army base adds $2 million to a state's local economy each year. In addition, in terms of increased security, the annual marginal benefit to Katlandia of having an additional army base is shown below. The total cost of an army base is $8 million per year. Suppose the department of defense proposes to build a third base in the state of New Porkswick. Apart

Suppose the department of defense proposes to build a third base in the state of New Porkswick. Apart

from the value of the additional security to the nation, the state economy will benefit by ________ per resident, and each resident's taxes will increase by ________. A. $20; $80 B. $200; $80 C. $200; $800 D. $20; $800

Static tax analysis assumes that

A) an increase in a tax rate may lead to a decrease in the tax base. B) an increase in a tax rate will lead to an increase in the tax base. C) an increase in a tax rate will leave the tax base unchanged. D) the tax base will always remain unchanged.