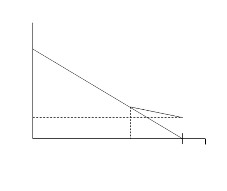

Consider a negative income tax. As discussed in your textbook, under the negative income tax, each person is entitled to a grant of G dollars per month. For every dollar the person earns, the grant is reduced by t dollars. Suppose G = 200 and t = 0.40. Consider an individual whose hourly wage is $10. There are 30 days in a month (so T is 720). Sketch the budget constraint before and after the introduction of a negative income tax.

What will be an ideal response?

You might also like to view...

A rational choice is ___________

A. the best thing you must forgo to get something B. what you are willing to forgo to get something C. made by comparing marginal benefit and marginal cost D. the best for society

Adding members to a military alliance _____

a. will always strengthen the alliance b. will cause the alliance to dissolve c. might weaken the alliance d. will always weaken the alliance

The demand for money curve will shift to the left when

a) the interest rate increases b) the price level increases c) aggregate output decreases d) the price of bonds is expected to decrease e) all of the above will shift the money demand curve to the left

The opportunity cost of holding money is measured by

A. the price of government bonds. B. the return from company stock shares that the money can buy. C. the interest yield that could have been earned by holding some other asset. D. the liquidity of interest-bearing assets.