On September 2, of this year, Keshawn sold land to Rex, his nephew, for $400,000. Keshawn's basis in the land was $100,000. Rex agreed to pay his uncle $40,000 this year, and $60,000 each year for the next six years plus interest. One month later, Rex sold the land to Theo, an unrelated party, for $450,000. Based on this information, Keshawn must report

A) $0. Rex reports gain of $300,000.

B) gain of $225,000 this year.

C) gain of $225,000 this year plus interest in following six years.

D) gain of $30,000 this year, and gain in each of the following six years of $45,000 plus interest.

D) gain of $30,000 this year, and gain in each of the following six years of $45,000 plus interest.

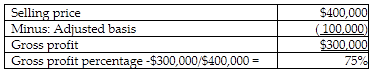

A nephew is not considered a related person. Calculation of gain under installment sale rules does not change for Kevin as a result of nephew's resale of land.

$40,000 × .75 = $30,000

$60,000 × .75 = $45,000

You might also like to view...

Actual overhead costs are applied directly to the work in process inventory account

Indicate whether the statement is true or false

An overstatement of beginning inventory in a period will result in an overstatement of gross margin in the next period

Indicate whether the statement is true or false

Arbitration differs from other forms of alternative dispute resolution in that a third party hearing a dispute makes a decision for the parties.

Answer the following statement true (T) or false (F)

Managers using the Boston Consulting Group growth-market share matrix are assessing the potential of a firm's existing SBUs to generate cash needed to invest in other businesses

Indicate whether the statement is true or false