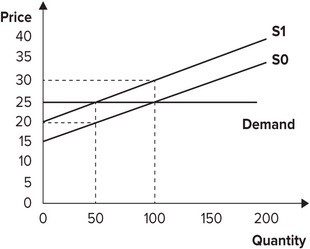

Refer to the graph shown. Initially, the market is in equilibrium with price equal to $25 and quantity equal to 100. As a result of a per-unit tax imposed by the government, the supply curve shifts from S0 to S1. The effect of the tax is to:

A. reduce producer surplus by $400.

B. give government tax revenues of $400.

C. reduce producer surplus by $375.

D. give government tax revenues of $100.

Answer: C

You might also like to view...

The production possibilities curve tells us that if full employment exists and a nation wishes to permanently increase its production of military goods, it must

A. also increase its production of nonmilitary goods. B. reduce its output of nonmilitary goods. C. suffer inflation. D. suffer unemployment.

The new classical model implies that substitution of debt for tax financing

a. increases aggregate demand and exerts an expansionary effect on real output. b. is highly effective against inflation. c. reduces savings because it increases both the current and future tax liability of households. d. leaves wealth, and therefore aggregate demand, unchanged because the debt will require higher future tax rates.

Related to the Economics in Practice on page 26: How did the introduction of the microwave oven in 1960 affect the market for frozen food?

A. It increased the financial cost of alternative methods of food preparation, such as conventional ovens. B. It encouraged people to leave the work force by making cooking easier and less time-consuming. C. It reduced the opportunity cost of eating frozen food by decreasing the amount of time required to prepare frozen meals. D. It made frozen foods more appealing by increasing the variety of meals that could be frozen and reheated.

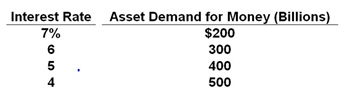

Refer to the table. Suppose that the transactions demand for money is equal to 20 percent of the nominal GDP, the supply of money is $800 billion, and the asset demand for money is that shown in the table. If the nominal GDP is $2000 billion, the equilibrium interest rate is:

A. 4 percent

B. 5 percent

C. 6 percent

D. 7 percent