Samuel Tate enters into a contract with Bill Smith. Under the terms of this contract, Smith is to pay Tate $7,000 and Tate is to build a garage, repair a boat, and build a doghouse. If the doghouse has not yet been built, this is an example of a(n):

a. quasi contract.

b. illusory contract.

c. executory contract.

d. executed contract.

c

You might also like to view...

Which of the following characteristics describes a professional, effective PowerPoint slide?

a. all information incorporated into a few slides with a lot of text b. many different colors on each slide c. timed d. information spread onto several slides

The process of handling customer requests for new standard software or a laptop computer is called ____.

A. change management B. request management C. request fulfillment D. incident management

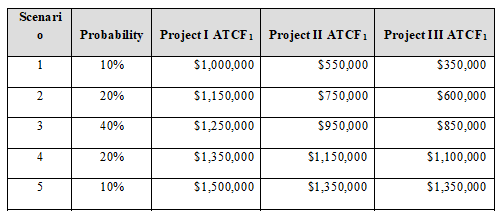

Powerful Wind, Inc. is a wind turbine manufacturer that is considering three investment projects: I, II, and III, that will cost $2,500,000, $2,300,000, and $3,700,000, respectively. The projects have an expected life of three, five, and seven years, correspondingly. The firm’s Vice President of Finance has estimated the probability distribution for each project’s first after-tax cash flow (ATCF1) as shown in the following table:

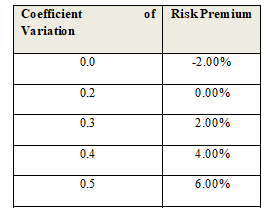

The Vice President of Finance uses the risk-adjusted discount technique to evaluate investment projects. He allocates risk premiums based on the coefficient of variation of each project’s after-tax cash flows according to the following table:

1. Each project’s after-tax cash flows are expected to grow at an annual rate of inflation of 3%.

a) Determine the expected cash flow, standard deviation, and coefficient of variation of each project in Year 1.

b) If the firm’s WACC is 15%, what is the appropriate risk-adjusted required rate of return of each project?

c) Using the appropriate discount rates, determine the payback period, discounted payback period, NPV, PI, IRR, and MIRR for each project.

d) If the projects are mutually exclusive, which project should be accepted? Answer the same question assuming they are independent projects.

6. Use the data of the previous problem to perform the following analysis:

a) Perform a sensitivity analysis using a Data Table. Determine the NPV, IRR, and PI as the ATCF1 takes on each possible outcome.

b) Determine the expected value and standard deviation of the NPVs, PI, and IRR of all projects.

c) Determine the coefficient of variation of the NPV, PI, and IRR of all projects.

d) Calculate the probability of a negative NPV, a PI less than one, and an IRR less than the required return for all projects.

e) Based on your results for parts (a), (b), (c), and (d), which project should be accepted?

What are five ways that an organization could reduce product costs? Provide an example of how each method would cause cost reduction