How do supply-side advocates respond to critics? How valid is their defense?

What will be an ideal response?

Supply-side economists argue that the Reagan tax cuts in the 1980 proved the Laffer Curve works as predicted. Taxes were cut from 50 to 28 percent and tax revenues were substantially higher by the end of the 1990.

The criticisms of this position are based on several explanations. The tax cuts came at a time of recession, so the tax cuts helped boost aggregate demand and increase GDP to its potential level. This change caused the Laffer Curve to shift rightward, increasing tax revenues and compensating for the reduction in tax rates. Moreover, the tax cuts didn’t produce any long-run shifts in long-run aggregate supply, savings fell as a percentage of personal income, productivity growth was slow, and real GDP growth wasn’t notably strong.

There is general agreement that cuts in tax rates reduce revenues by less than the percentage of the tax cut and when taxes are increased, tax revenues increase by less than the percentage of the tax rate increase. Thus changes in marginal tax rates do alter economic behavior.

You might also like to view...

Refer to Table 18.1. M2 in this simple economy equals

A) $1,050. B) $4,050. C) $4,550. D) $5,100.

A marginal propensity to consume of 0.84 results in a multiplier of

A) 6.25. B) 1.19. C) 0.16. D) 0.84. E) 1.84.

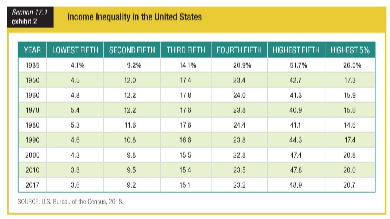

Judging from the table showing income inequality in the United States, the Great Depression and new social programs of the 1930s, plus the impact of World War II, caused the proportion of income earned by the wealthiest Americans to ______.

a. drop significantly

b. drop slightly

c. rise slightly

d. rise dramatically

If a hurricane were to wipe out the majority of the eastern seaboard in the United States:

A. neither the short-run nor long-run aggregate supply curves would be affected. B. only the long-run aggregate supply curve would shift left. C. only the short-run aggregate supply curve would shift left. D. the long-run and short-run aggregate supply curves would both shift left.