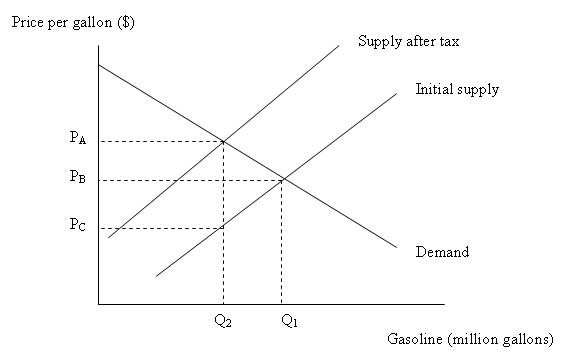

Figure 16.5Figure 16.5 depicts the market effects of a gasoline tax. How much revenue does the government collect from the gasoline tax?

Figure 16.5Figure 16.5 depicts the market effects of a gasoline tax. How much revenue does the government collect from the gasoline tax?

A. (PA-PC)xQ2 dollars

B. (PA-PC)xQ1 dollars

C. (PA-PB)xQ2 dollars

D. (PA-PB)xQ1 dollars

Answer: A

You might also like to view...

When a firm's marginal productivity of an input eventually declines as the quantity of input increases, then the production is experiencing

a. Diminishing returns to scale b. Diminishing marginal product c. Increasing returns to scale d. Increasing marginal product

Which of the following is true of price changes in currencies under the fixed-rate system?

a. Frequent occurrence b. Low magnitude c. Infrequent, but high magnitude d. Frequent, but low magnitude

How does the idea of a leaky bucket relate to the study of income distribution?

What will be an ideal response?

The free-rider problem is encountered when

A. all individuals are willing to pay for what they consume. B. all individuals who consume a public good pay for it. C. someone benefits from the consumption of a public good without paying his or her full share. D. all goods consumed and produced are private goods.