Discuss some of the general conclusions arrived at about supply-side tax initiatives

1 . The likely effectiveness of supply-side tax cuts depends on what kinds of taxes are cut. Tax reductions aimed at stimulating business investment are likely to pack more punch than tax reductions aimed at getting people to work longer hours or to save more.

2 . Such tax cuts probably will increase aggregate supply much more slowly than they increase aggregate demand. Thus, supply-side policies should not be regarded as a substitute for short-run stabilization policy but, rather, as a way to promote faster economic growth in the long run.

3 . Demand-side effects of supply-side tax cuts are likely to overwhelm supply-side effects in the short run.

4 . Supply-side tax cuts are likely to widen income inequalities.

5 . Supply-side tax cuts are almost certain to lead to larger budget deficits.

You might also like to view...

Financial innovation is

A) the process of turning assets into a more liquid form. B) the development of new financial products and services. C) responsible for credit cards being included as part of money. D) causing a decrease in bank profits.

A good that people must actually consume before they can determine qualities is called

A) a credence good. B) a search good. C) an experience good. D) a persuasive good.

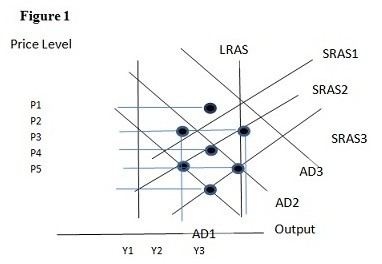

Using Figure 1 above, if the aggregate demand curve shifts from AD1 to AD2 the result in the long run would be:

A. P1 and Y2. B. P2 and Y2. C. P3 and Y1. D. P2 and Y3.

The point at which buyers and sellers "agree" on the quantity of a good they are willing to exchange at a given price is called:

A. equilibrium. B. maximization. C. optimization. D. market collapse.