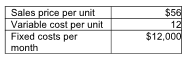

Calculate the contribution margin ratio. (Round your answer to two decimal places.)

Carrabelle Company has provided the following information:

A) 21.43%

B) 82.35%

C) 64.71%

D) 78.57%

D) 78.57%

Contribution margin ratio = Contribution margin / Net sales revenue

![]()

You might also like to view...

On January 1, 2017, Cale Corp. paid $1,020,000 to acquire Kaltop Co. Kaltop maintained separate incorporation. Cale used the equity method to account for the investment. The following information is available for Kaltop's assets, liabilities, and stockholders' equity accounts on January 1, 2017: BookValuesFairValuesCurrent assets$120,000 $120,000 Land 72,000 192,000 Building (twenty year life) 240,000 268,000 Equipment (ten year life) 540,000 516,000 Current liabilities 24,000 24,000 Long-term liabilities 120,000 210,000 Common stock 228,000 Additional paid-in capital 384,000 Retained earnings 216,000 ??Kaltop earned net income for 2017 of $126,000 and paid dividends of $48,000 during the year. ?If Cale Corp. had net income of

$444,000 in 2017, exclusive of the investment, what is the amount of consolidated net income? A. $444,000. B. $571,000. C. $570,000. D. $569,000. E. $566,400.

We are interested in determining whether the opinions of the individuals on gun control (as to Yes, No, and No Opinion) are uniformly distributed.A sample of 150 was taken and the following data were obtained

Do you support gun control Number of Responses Yes 40 No 60 No Opinion 50 The conclusion of the test with alpha = 0.05 is that the views of people on gun control are: A) uniformly distributed. B) not uniformly distributed. C) inconclusive. D) None of the above

All but one of the following is true of common-size income statements.

A) Each income statement item is standardized by dividing it by total assets. B) Income statement accounts are represented as percentages of sales. C) Each income statement item is standardized by dividing it by sales. D) Common-size financial statement analysis is a specialized application of ratio analysis.

Other things equal, a firm's sustainable growth rate could increase as a result of:

A. increasing total assets. B. decreasing the return on equity. C. increasing the payout ratio. D. increasing the plowback ratio.