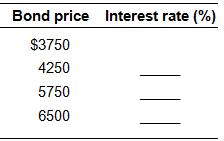

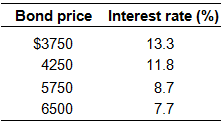

Suppose that a bond having no expiration date has a face value of $5000 and pays a fixed amount of interest of $500 annually. Compute and enter in the spaces provided the effective interest rate (to one decimal place) that a bond buyer could receive at the new bond price.

You might also like to view...

A funded pension plan _____

a. pays current beneficiaries from the contributions of current contributors b. pays current beneficiaries from the contributions of new contributors c. maintains assets equal to the present value of future liabilities d. is functionally equivalent to a pay-as-you-go system, except for the pension plan is not compulsory

The primary benefit of monetary exchange compared to barter exchange is: a. the possibility of tracking trade for tax purposes

b. increased time devoted to finding trade partners. c. increased time devoted to shopping for what we want. d. increased efficiency in arranging transactions.

Suppose the population (age 16 and over) of Panama is 50 million; 4 million are unemployed, and 36 million hold jobs. What are the rates of unemployment and labor force participation of Panama?

a. Unemployment is 10 percent, and labor force participation is 80 percent. b. Unemployment is 10 percent, and labor force participation is 75 percent. c. Unemployment is 11 percent, and labor force participation is 80 percent. d. Unemployment is 11 percent, and labor force participation is 90 percent.

Two drawbacks in using fiscal policy as a stabilization tool are that fiscal policy can affect ________ as well as aggregate demand and that fiscal policy is ________.

A. consumption; too flexible B. potential output; offset by automatic stabilizers C. potential output; not flexible enough D. consumption; offset by automatic stabilizers