What is income redistribution?

What will be an ideal response?

Income redistribution is the shifting of money from people at one income level to people at a lower income level. Progressive taxes represent a form of income redistribution. The government extracts money from wealthier taxpayers and redistributes some of that money to the less wealthy through many government programs.

You might also like to view...

Answer the following statements true (T) or false (F)

1. The difference between the ATC and the AVC must represent the AFC. 2. Average revenue is synonymous with price. 3. Marginal revenue is the increase in total revenue per additional unit of input. 4. Average revenue times total output equals total profit. 5. Marginal product can never fall below zero.

The dominant Keynesian view of the 1960s and 1970s stressed that

What will be an ideal response?

A firm typically achieves its position as a monopolist as a result of

A) a small market and a constant average cost. B) a downward sloping demand for the product. C) barriers to entry. D) the absence of long-run profits in an industry.

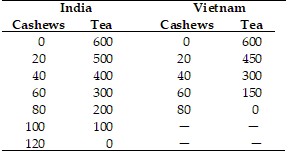

Refer to the information provided in Table 33.5 below to answer the question(s) that follow. Cashews are measured in bushels and tea is measured in pounds (lbs.)

Table 33.5 Refer to Table 33.5. In India, the opportunity cost of

Refer to Table 33.5. In India, the opportunity cost of

A. a lb. of tea is 1/6 of a bushel of cashews. B. a lb. of tea is 1/5 of a bushel of cashews. C. a bushel of cashews is 6 lbs. of tea. D. a bushel of cashews is 5 lbs. of tea.