Empirical evidence suggests that the relationship between a firm’s investment and its stock prices is

a) strongly negative

b) weakly negative

c) nonexistent; the two variables are independent

d) weakly positive

e) strongly positive

d) weakly positive

You might also like to view...

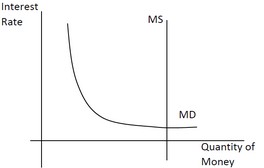

Use the following diagram to answer the next question. Based on this diagram, we can say ________.

Based on this diagram, we can say ________.

A. monetary policy is likely to be more effective at fighting a recession than fiscal policy B. investment demand is very sensitive to changes in the interest rate C. an increase in the money supply will have little effect on investment or aggregate demand D. expansionary monetary policy will be more effective at increasing aggregate supply than aggregate demand

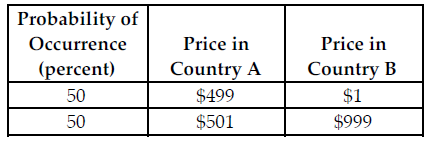

Refer to the table below. Because the extent of variation in the price of the input is ________ in Country B compared to Country A, it is less risky to plan to purchase the input in Country ________.

The above table provides the probability distribution of price of an input next year in Country A and Country B.

A) lower; A

B) greater; A

C) greater; B

D) lower; B

The balance of payments ____________

a. is always zero b. is always one c. is positive when the nation has a trade surplus d. is negative when the nation has a trade deficit e. is positive when the nation has a trade deficit

True/false- the multiplier rises as the MPC rises

a. true b. false