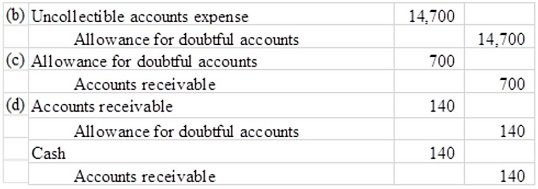

The following information is available for Phoenix Corporation, which uses the allowance method. Phoenix expects 3% of sales on account to be uncollectible.?Sales on account: $490,000?Collections on account: $440,000Required:a) Compute the amount of uncollectible accounts expense for Year 1.b) Prepare the journal entry to record uncollectible accounts expense for Year 1.c) In Year 2, after several attempts of collection, Phoenix wrote off accounts that could not be collected of $700. Prepare the journal entry to record the write-off of the $700.d) Later in Year 2, Phoenix received a check for $140 from one of the customers whose account had been written off in c), above. Prepare the required journal entries to record the collection of the $140.

What will be an ideal response?

a) $14,700

b)

a) $490,000 × 3% = $14,700

You might also like to view...

Which of the following is not an advantage of a perpetual inventory system?

A) assists in the prevention of stock outs B) requires less data processing effort than periodic systems C) maintains up-to-date inventory and cost of goods sold balances D) provides evidence of inventory shrinkage

Fact Pattern 24-1AFlik draws a check payable to "DeliMart" to buy groceries.Refer to Fact Pattern 24-1A. With respect to Flik's check, DeliMart is

A. the drawee. B. the drawer. C. the maker. D. the payee.

Dylan is a supervisory manager in the production department of a tea manufacturing company. Each year, he actively participates in the budgeting process of the company. His input is valued by the top management as he is able to identify the issues in his department. In this scenario, it can be said that Dylan's company follows the _____ to budgeting.

A. top-down approach B. incremental approach C. bottom-up approach D. zero-based approach

When making a purchasing decision, deciding what product to buy is referred to as product brokering

Indicate whether the statement is true or false