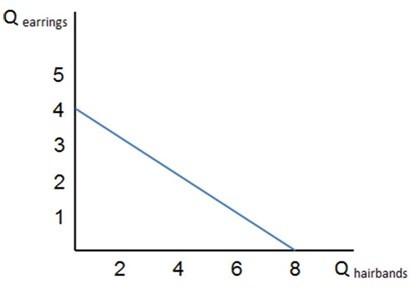

The slope of the budget line in the graph shown:

The slope of the budget line in the graph shown:

A. represents the relative marginal utilities from consuming the two goods.

B. is the consumer's income level.

C. measures the total utility the consumer gets from consuming the two goods.

D. represents the opportunity cost of the two goods relative to each other.

Answer: D

You might also like to view...

At the end of World War II in 1945, many economists and business managers expected that the U.S. economy would enter a severe recession. At that time, Sears and Montgomery Ward were the two largest department store chains in the country

Sears CEO Robert Wood expected continuing prosperity and opened new stores. Montgomery Ward CEO Sewell Avery expected falling incomes and rising unemployment and closed a number of existing stores. The results of their actions were seen during the late 1940s, when A) Sears declared bankruptcy and was purchased by Montgomery Ward. B) Montgomery Ward weathered the economic downturn in better financial shape than Sears. C) Sears had to close many of the new stores it had opened following the end of the war. D) Sears rapidly gained market share at Montgomery Ward's expense.

The budget of an economy is said to be in deficit when: a. federal outlays exceed revenues

b. federal revenues exceed outlays. c. anticipated inflation rate exceeds its actual rate. d. there is a loss of value of a country's currency with respect to one or more foreign reference currencies. e. anticipated interest rate exceeds its actual rate.

The size of the effect of a given deposit of cash into a demand deposit account on the money supply is smaller:

a. the greater the fraction of money people want to hold as currency and the greater the fraction of deposits banks want to hold as excess reserves. b. the greater the fraction of money people want to hold as currency and the smaller the fraction of deposits banks want to hold as excess reserves. c. the smaller the fraction of money people want to hold as currency and the greater the fraction of deposits banks want to hold as excess reserves. d. the smaller the fraction of money people want to hold as currency and the smaller the fraction of deposits banks want to hold as excess reserves.

Why does the Federal Reserve System raise interest rates?

A. To overcome inequalities of income distribution B. To increase demand for products C. To decrease supply of products D. To fight inflation