If you purchased a newly issued 30-year bond from American Airlines with a face value of $1,000 and a coupon payment of 3 percent, American Airlines would pay you

A) $33.33 per year plus 3 percent per year for 30 years.

B) $30 per year for 30 years.

C) $30 per year for 30 years plus $1,000 at the end of the 30th year.

D) $33.33 per year for 30 years plus $1,000 at the end of the 30th year.

C

You might also like to view...

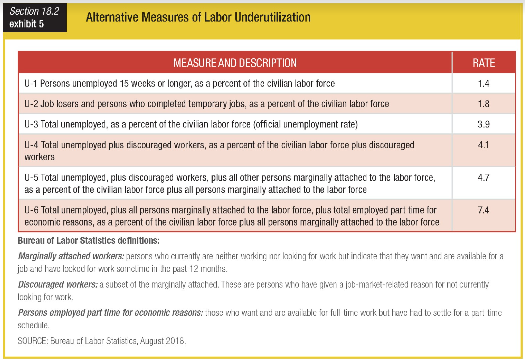

Which of the following groups is considered a subset of marginally attached workers?

a. discouraged workers

b. job losers and persons who completed temporary jobs

c. persons unemployed 15 weeks or longer

d. persons employed part time for economic reasons

Suppose that a nation has a GDP of 1.0 trillion dollars in 2000. If a country grows at an average rate of 3.0 % per year over a fifteen year period, then its compounded GDP at the end of the 15 year period should be:

A. 1.47 Tr. B. 1.33 Tr. C. 2.00 Tr. D. 1.56 Tr.

The purpose of the IMF is to:

A. provide developing countries with short-term loans and technical assistance. B. determine monetary and fiscal policy in developing countries. C. determine exchange rates for developing countries. D. buy and sell the currencies of developing countries in order to stabilize their value.

Explain why nominal wages are a function of the expected price level

What will be an ideal response?