When the government reduces my income tax by $0.30 for every $1.00 that I contribute to a charity, the government is effectively

a. alleviating the negative externalities that are associated with charitable giving.

b. imposing a negative externality on those who do not pay income taxes.

c. encouraging a private solution to a positive-externality problem.

d. encouraging a private solution to a negative-externality problem.

c

You might also like to view...

Answer the following statement(s) true (T) or false (F)

1. The largest “hole” in the earth’s ozone layer occurs over North America. 2. Scientists agree that the presence of chlorofluorocarbons (CFCs) in the atmosphere most likely explains the existence of the ozone hole. 3. The release of CFCs associated with the production of refrigeration units is an example of a negative externality. 4. The Kyoto Protocol banned the use of CFCs. 5. CFC allowance trading was an integral part of achieving the objectives of the Montreal Protocol.

Irving Fisher derived the quantity theory of money from the equation of exchange. What two assumptions did he make to derive the theory and what is the basic assertion of the theory?

What will be an ideal response?

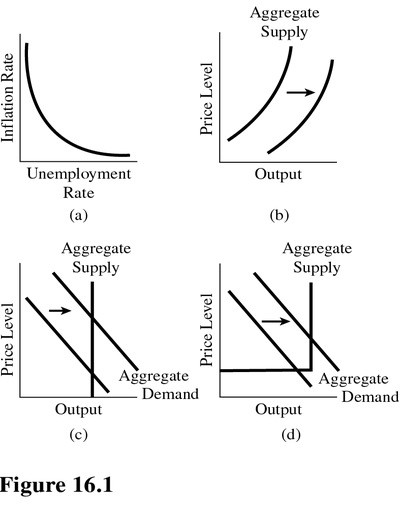

Choose the letter of the diagram in Figure 16.1 that Keynesians would use to illustrate the effects of stimulative fiscal policy on the economy.

Choose the letter of the diagram in Figure 16.1 that Keynesians would use to illustrate the effects of stimulative fiscal policy on the economy.

A. a. B. b. C. c. D. d.

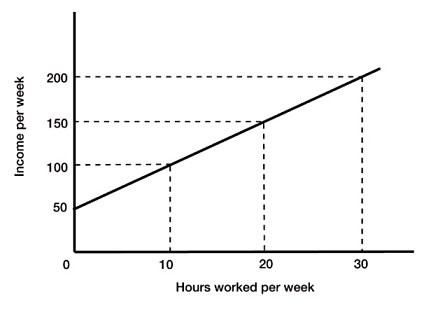

Figure 1A.1Refer to Figure 1A.1. The slope of the line between the points where hours worked per week are 20 and hours worked per week are 30 is:

Figure 1A.1Refer to Figure 1A.1. The slope of the line between the points where hours worked per week are 20 and hours worked per week are 30 is:

A. 0.2. B. 5. C. 10. D. 50.