Describe the three major disadvantages of flexible exchange rates.

What will be an ideal response?

First, flexible exchange rates are subject to great volatility, and thus create uncertainty in exchange rate markets. This uncertainty can adversely affect trade because it creates more risks for those businesses that import and export goods and services. Second, a fall in the international value of a nation’s currency will worsen the terms of trade for that nation. A fall in the value of a nation’s currency will require that nation to export more goods and services to finance the previous level of imports. Third, changes in exchange rates create instability in the domestic economy. Depreciation or appreciation of a nation’s currency affects the domestic economy. Inflationary pressures can arise from a depreciation in the value of a nation’s currency because it increases the demand for exports and increases the prices of goods imported. Appreciation of a nation’s currency reduces exports and increases imports possibly creating unemployment in export-related industries.

You might also like to view...

Competitive markets tend to eliminate economic discrimination, but there are many historical examples of firms that hired few, or no, black or female workers

Which of the following is not a reason for the persistence of this form of discrimination? A) Some white consumers were unwilling to buy from companies that employed black workers. B) If discrimination makes it difficult for a member of a group to be hired in a particular occupation, there is less incentive for members of the group to be trained to enter that occupation. C) Laws passed by the federal government made it more expensive to hire black or female workers. As a result, it was less expensive for employers to hire mostly white male workers. D) In many cases, white workers refused to work with black workers.

The two major problems caused by asymmetric information are the moral-hazard problem and the principal-agent problem

a. True b. False Indicate whether the statement is true or false

Which of the following would both make the interest rate on a bond higher than otherwise?

a. the interest it pays is taxed and it is long term b. the interest it pays is taxed and it is short term c. the interest it pays is tax exempt and it is long term d. the interest it pays is tax exempt and it is short term

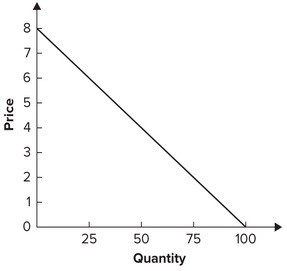

Refer to the graph shown. Total revenue is at a maximum when price is:

A. $6. B. $8. C. $4. D. $2.