A construction project in Congressman Foghorn's district is unfinished. Foghorn has asked that a new appropriations bill include funds to complete the project, despite a report by an independent agency that the project is a waste of taxpayer money

Foghorn's project is a bridge that crosses a river between two cities in his district. The press has criticized Foghorn and dubbed the project "a bridge too far" since another bridge, located closer to the same two cities Foghorn's bridge will connect, already exists and can accommodate all traffic between the two cities. Foghorn argues that if the bridge project is not completed, the $50 million already spent will have been wasted. Is Foghorn's argument economically rational? Explain your answer.

What will be an ideal response?

Foghorn's argument is not rational. The $50 million that has been spent on bridge construction is a sunk cost that should be ignored when deciding whether to spend additional tax revenue on the bridge. Foghorn should argue that the additional, or marginal, cost of finishing the project is less than the additional benefits that would be provided by the second bridge. If the estimated additional benefits are less than the additional cost the bridge should not be finished.

You might also like to view...

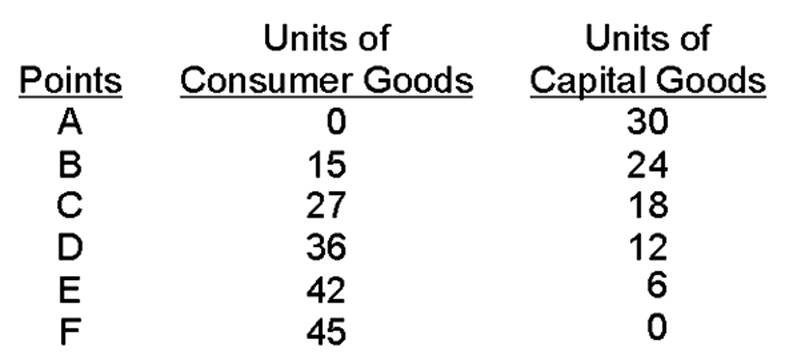

What is the opportunity cost of going from point A to point B?

Assume that the Fed has a target inflation rate of 2% and that the values for how much the nominal target federal funds rate responds to a deviation of inflation from its target, g, and how much the nominal target federal funds rate responds to real

GDP, h, are both 0.5. According to the Taylor rule, if inflation increases by 6%, the real interest rate will increase by A) 3%. B) 4%. C) 6%. D) 9%.

Bill lives in Montana and likes to grow zucchini. He applies fertilizer to his crops twice during the growing season and notices that the second layer of fertilizer increases his crop, but not as much as the first layer. What economic concept best explains this observation?

A. The law of diminishing marginal utility. B. The law of diminishing returns. C. Return equalization principle. D. The principal-agent problem.

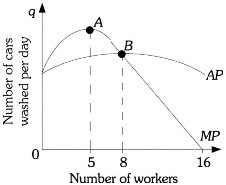

Refer to the information provided in Figure 7.5 below to answer the question(s) that follow.  Figure 7.5Refer to Figure 7.5. Increasing returns continue until the ________ worker is hired.

Figure 7.5Refer to Figure 7.5. Increasing returns continue until the ________ worker is hired.

A. first B. fifth C. eighth D. sixteenth