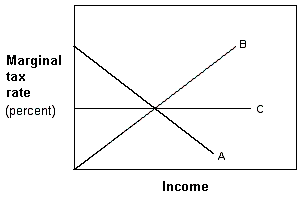

Exhibit 12-4 Marginal tax rate lines

In Exhibit 12-4, line C represents a(n):

A. regressive tax.

B. progressive tax.

C. proportional tax.

D. ability-to-pay tax.

Answer: C

You might also like to view...

Starting from long-run equilibrium, a large tax increase will result in a(n) ________ gap in the short-run and ________ inflation and ________ output in the long-run.

A. recessionary; lower; potential B. expansionary; lower; potential C. expansionary; higher; potential D. recessionary; lower; lower

If the value of the U.S. dollar changes from 1.2 euros to 1.4 euros, we would expect that the United States would experience a ________ in exports and a ________ in imports

A) rise; rise B) fall; fall C) rise; fall D) fall; rise

If an exporter wants to limit the effect of possible changes in the exchange rate on the value of her exports, then she can adopt a strategy known as

A) floating. B) speculating. C) hedging. D) appreciating.

Which of the following makes it more difficult for monetary policy makers to time policy changes correctly?

a. Monetary policy makers cannot act without congressional approval. b. The primary effects of the policy change will not be felt for 6 to 15 months into the future. c. The Board of Governors of the Federal Reserve System does not meet very often. d. Monetary policy affects only the general level of prices; it exerts no impact on real variables such as output and employment.