In the figure above, the SLF curve is the supply of loanable funds curve and the PSLF curve is the private supply of loanable funds curve. If there is no Ricardo-Barro effect and the government now runs a balanced budget,

A) the interest rate will increase from 4 percent to 6 percent.

B) there is a surplus of investment funds and the interest rate falls to 4 percent.

C) there is shortage of investment funds of $0.4 trillion.

D) the equilibrium interest rate is 6 percent and investment is $1.6 trillion.

E) the equilibrium interest rate is 4 percent and investment is $1.8 trillion.

D

You might also like to view...

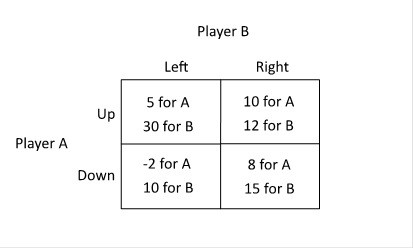

Refer to the figure below. In this game, the dominated strategy for Player A:

A. will depend on Player B's move. B. is to play down. C. is to play up. D. is to cooperate with Player B.

Table 7-5 Stereos produced 0 1 2 3 4 5 6 Total cost (in $) 200 325 410 475 550 660 825 Table 7-5 shows short-run total cost figures for a stereo manufacturer. At what output level does short-run average variable cost reach a minimum?

A. 2 B. 3 C. 4 D. 5

What are some of the drawbacks, as you see them, to a program like Workfare?

What will be an ideal response?

If diminishing marginal returns is in effect

A) marginal costs fall. B) marginal costs rise. C) average costs fall. D) average revenue is constant.