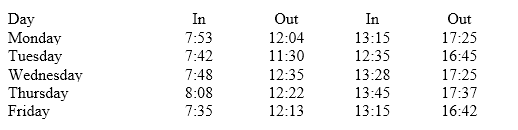

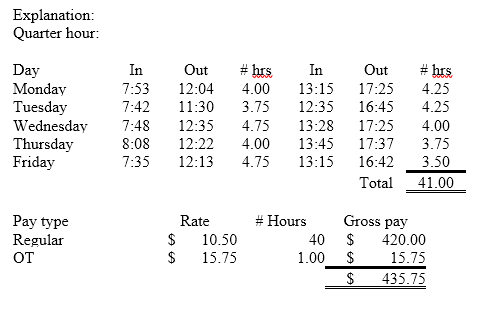

Alan is an hourly worker who earns $10.50 per hour and is paid overtime for any time over 40 hours per week. During a weekly period, he worked the following hours:

What is his gross pay for the week using both quarter-hour and hundredth hour methods? (Do not round interim calculations. Round final answer to two decimal places.)

A) $420.00; $439.69

B) $ 435.75; $439.43

C) $420.00; $429.67

D) $420.00; $434.69

B) $ 435.75; $439.43

You might also like to view...

Which of the following would be considered the MOST effective project reward?

A. Public recognition B. Lump-sum cash award C. Desirable job assignments D. All-expenses-paid trip for team members and their families E. Using negative reinforcement to motivate adequate performance

FreshFoods, Inc. sells American gourmet foods to merchandisers in Singapore. Prepare the journal entries for FreshFoods, to record the following transactions. Include any year-end adjustments.Dec 20Sold items to Tan, Inc., for 60,000 Singapore dollars. The exchange rate was $0.476 per Singapore dollar. The purchase terms were n/30.Dec 31The exchange rate was $0.480 per Singapore dollar.Jan 17Received payment from Tan for the December 20 sale. The exchange rate was $0.495 per Singapore dollar.

What will be an ideal response?

In the formula for computing the range, what does the letter l represent?

a.Range b.Variability c.Highest score d.Lowest score

Which of the following expenses or losses could create a net operating loss for an individual taxpayer?

A) large losses on sales of investment assets B) an operating loss from a sole proprietorship C) large charitable contributions D) all of the above