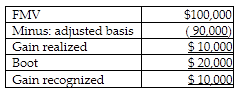

Henry transfers property with an adjusted basis of $90,000 and an FMV of $100,000 to a newly-formed corporation in a Sec. 351 exchange. Henry receives stock with an FMV of $80,000 and a short-term note with a $20,000 FMV. Henry's recognized gain is

A) $0.

B) $5,000.

C) $10,000.

D) $20,000.

C) $10,000.

Realized gain is recognized to the extent of boot received. The short-term note is boot, but only $10,000 (the realized gain) is recognized.

You might also like to view...

Low verbal immediacy is intended to engage or compel the other party, while high verbal immediacy is intended to create a sense of distance or aloofness.

Answer the following statement true (T) or false (F)

Branding decisions include determining a product price

Indicate whether the statement is true or false

Marketers can expect people who are at the same life stage to process stimuli in the same ways

Indicate whether the statement is true or false

On May 22, Jarrett Company borrows $7,500 from Fairmont Financing, signing a 90-day, 8%, $7,500 note. What is the journal entry needed to record the transaction by Jarrett Company?

A. Debit Accounts Payable $7,500; credit Notes Payable $7,500. B. Debit Cash $7,500; credit Notes Payable $7,500. C. Debit Cash $7,650; credit Notes Payable $7,650. D. Debit Cash $7,500; credit Accounts Payable $7,500. E. Debit Notes Receivable $7,500; credit Cash $7,500.