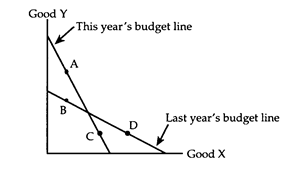

Consider an income tax and a head tax, the sizes of which have been set so that the government collects the same amount of money under each tax. Which tax does the consumer prefer?

a. The consumer is indifferent between the two taxes, since he pays the same amount of money under each tax.

b. The consumer prefers the head tax, because it does not lower the relative wage as does the income tax.

c. The consumer prefers the income tax, because it can be avoided by increasing the amount of leisure time consumed.

d. The consumer may prefer either tax, depending on whether the income tax increases or decreases the number of hours of work at the optimum.

b. The consumer prefers the head tax, because it does not lower the relative wage as does the income tax.

You might also like to view...

Expansionary monetary policy will have what effect on the components of aggregate demand?

A) Consumption, investment, and net exports will rise. B) Consumption will rise, but investment and net exports will fall. C) Consumption and investment will rise, but net exports will fall. D) Consumption will fall, but investment and net exports will rise.

Aggregate output is increased by a decrease in

A) autonomous consumption. B) government spending. C) planned investment. D) net taxes.

In the Solow growth model, given the values of A, s, n, and d, the economy has an equilibrium growth rate of real GDP per capita, (Y/N), equal to

A) n. B) n - d. C) s - n. D) (s - d)/n. E) zero.

If the value of the marginal product of labor is less than the wage, then the firm could

a. increase profit by hiring additional labor. b. increase profit by reducing the amount of labor hired. c. increase revenue by lowering output. d. reduce total cost by hiring additional workers.