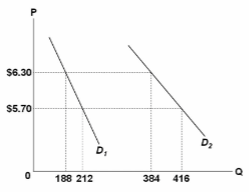

Refer to the diagram. Between prices of $5.70 and $6.30:

A. D 1 is more elastic than D 2 .

B. D 2 is an inferior good and D 1 is a normal good.

C. D 1 and D 2 have identical elasticities.

D. D 2 is more elastic than D 1 .

A. D 1 is more elastic than D 2 .

You might also like to view...

Refer to Figure 4-9. The price buyers pay after the tax is

A) $12. B) $8. C) $5. D) $3.

Critics of government frequently assert that special interest groups favor transfer policies rather than economic growth policies

Indicate whether the statement is true or false

When a good with equally elastic demand and supply is taxed, the incidence of the tax is borne Group of answer choices

A) entirely by consumers. B) entirely by producers. C) by both consumers and producers. D) mostly by consumers. E) mostly by producers.

The demand for a product is likely to be more elastic

A. the shorter the time the consumer has to adjust to price changes. B. the lower the price of the good. C. the fewer the number of good substitutes. D. the less the essential nature of the good.