An issue of common stock is selling for $57.20. The year-end dividend is expected to be $2.32, assuming a constant growth rate of 4%. What is the required rate of return?

A) 10.3%

B) 10.1%

C) 8.1%

D) None of these options are correct

C) 8.1%

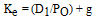

= ($2.32 / $57.20) + 0.04 = 8.1%

You might also like to view...

Which of the following is a way that a fragmented industry can be consolidated?

A. Using strategies to create meaningful scale economies. B. Creating a national brand where none previously existed. C. Lowering costs through the creation of scale economies by value innovations. D. Offering new ways to address customer’s demands such as wider product selection, longer operating hours, and lower prices. E. All of these are ways that a fragmented industry can be consolidated.

An unwillingness to share information out of fear of being taken advantage of is associated with which of the following obstacles to process integration?

a. Silo mentality b. Lack of knowledge c. Lack of trust d. Lack of information visibility

A common carrier is under a duty to serve the public to the limits of its capacity

Indicate whether the statement is true or false

A-Plus Linens sent the following notice to John C. Lincoln Hospital: "We'll pay you. Drop your current linen service and we'll give you $5 for every 100 pounds of linen you send our way." The notice sent by A-plus: A) is contract interference

B) is defamatory. C) is invasion of privacy. D) None of the above