How will an increase in the expected future exchange rate affect the current supply and demand curves for dollars?

What will be an ideal response?

An increase in the expected future exchange rate increases the return from holding U.S. dollars. As a result, the demand for dollars increases and the demand curve shifts rightward while the supply of dollars decreases and the supply curve shifts leftward.

You might also like to view...

Why is it customary to report price elasticity of demand in absolute value terms while cross elasticities and income elasticities are reported with their sign attached?

What will be an ideal response?

Suppose that at some point the spot exchange rate is equal to 100 yen per one U.S. dollar, while the interest rate in dollars is 6% and the interest rate in yen is 1%. What is the approximate forward rate that is consistent with this situation?

A) 95.3 yen per dollar B) 105 yen per dollar C) 107 yen per dollar D) 92 yen per dollar

Suppose the cross-price elasticity of demand between peanut butter and jelly is -2.50 . This implies that a 20 percent increase in the price of peanut butter will cause the quantity of jelly purchased to

a. fall by 8 percent. b. fall by 50 percent. c. rise by 8 percent. d. rise by 50 percent.

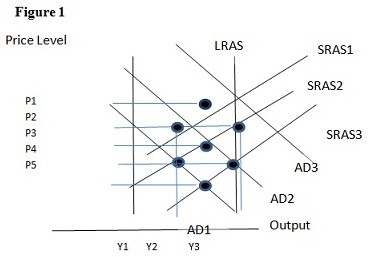

Using Figure 1 above, if the aggregate demand curve shifts from AD1 to AD2 the result in the short run would be:

A. P1 and Y2. B. P3 and Y1. C. P2 and Y2. D. P2 and Y3.