Professor Jeremy Siegel, of the University of Pennsylvania, did research showing that:

A. bonds really are less risky to hold over the long term.

B. owning stocks over the long run produces returns below the risk-free return.

C. the return on the S&P 500 for a 25-year period often produces returns below zero.

D. if an investor owns stocks for a very short time the risk is greater than if the stocks are held for a long time.

Answer: D

You might also like to view...

For the Coase theorem to work there must be clear assignment of property rights

Indicate whether the statement is true or false

By Marks buys a one-year German government bond (called a bund) for $400. He receives principal and interest totaling $436 one year later. During the year the CPI rose from 150 to 162

The nominal interest rate on the bond was ________, and the real interest rate was ________. A) 9%; 1% B) 9%; -1% C) 36%; 24% D) 36%; 12%

Drug trafficking leads to

A. a net outflow of money from the United States. B. a net inflow of money into the United States. C. no net outflow or net inflow.

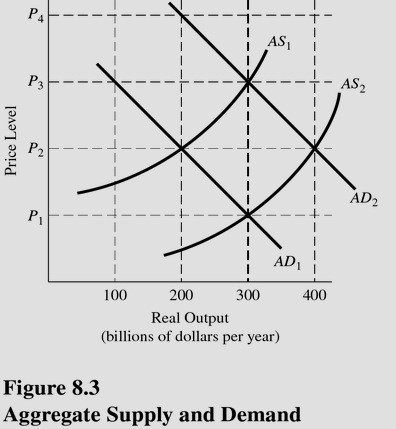

Macro equilibrium is established at which price level, given AD1 and AS1 in Figure 8.3?

Macro equilibrium is established at which price level, given AD1 and AS1 in Figure 8.3?

A. P1. B. P2. C. P3. D. P4.