Governmental assistance to the unemployed

A. is taxed as regular income by the federal government.

B. is opposed by Keynesian economists.

C. was abolished under the 1986 Tax Reform Act.

D. may increase unemployment because it enables the jobless to take more time to look for employment.

D. may increase unemployment because it enables the jobless to take more time to look for employment.

You might also like to view...

Refer to Figure 9.1. Assume the economy is initially at point A. The eventual change from a shock that increases investment expenditure is best represented by which long-run equilibrium combination of price level and real GDP?

A) P2; Y2 B) P3; Y1 C) P1; Y2 D) P2; Y1

The more inelastic the demand for a product, the more the actual burden of a tax on the product will:

a. fall on sellers. b. fall on buyers. c. fall equally on both buyers and sellers. d. create a larger deadweight loss (or excess burden).

A favorable balance of trade occurs when:

a. exports equal imports. b. the balance of payments balances. c. the current and capital account in the BOP are equal. d. the value of the exports of goods exceeds the value of the imports of goods. e. the value of the exports of goods is less than the value of the imports of goods .

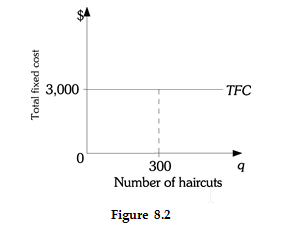

Refer to Figure 8.2 above. The total fixed costs for The Barber Shop are $3,000. If The Barber Shop produces 300 hair cuts, the average fixed costs are A) $.20. B) $5. C) $10. D) $100.