A tax imposed on the buyers of a good will raise the

a. price paid by buyers and lower the equilibrium quantity.

b. price paid by buyers and raise the equilibrium quantity.

c. effective price received by sellers and lower the equilibrium quantity.

d. effective price received by sellers and raise the equilibrium quantity.

a

You might also like to view...

A reduction in government spending causes the equilibrium level of aggregate output to ________ at any given interest rate and shifts the ________ curve to the ________, everything else held constant

A) rise; LM; right B) fall; IS; left C) fall; LM; left D) rise; IS; right

When prices drop in response to a decline in demand for an increasing cost industry

a. producer surplus will increase but rents may decrease. b. rent earned by elastically supplied inputs will decline by more than rent earned by inelastically supplied inputs. c. rent earned by elastically supplied inputs will decline by less than rent earned by inelastically supplied inputs. d. both producer surplus and rents will increase.

What are two underlying factors affecting input prices? How does a change in input prices affect aggregate supply?

What will be an ideal response?

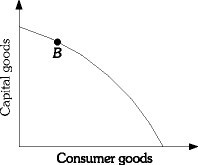

Refer to the information provided in Figure 2.2 below for the economy of Microland to answer the question(s) that follow. Figure 2.2Refer to Figure 2.2. If Microland's economy is at Point B, it could produce more capital goods

Figure 2.2Refer to Figure 2.2. If Microland's economy is at Point B, it could produce more capital goods

A. by sacrificing some consumer goods. B. only with additional resources. C. only with technological improvements. D. without sacrificing any consumer goods.