The difference between a tariff and a quota is that the revenue from the tariff goes to the

A) domestic consumer.

B) domestic producer.

C) domestic government.

D) foreign producers.

E) foreign government.

C

You might also like to view...

The Social Security system is financed by

A) a tax on individual retirement accounts. B) a payroll tax paid only by employers. C) a payroll tax paid by both employers and employees. D) a tax on luxury goods.

When a negative externality is present in a market, total surplus is:

A. higher when buyers only consider private costs. B. lower when buyers only consider private costs. C. lower when buyers consider social costs. D. None of these statements is true.

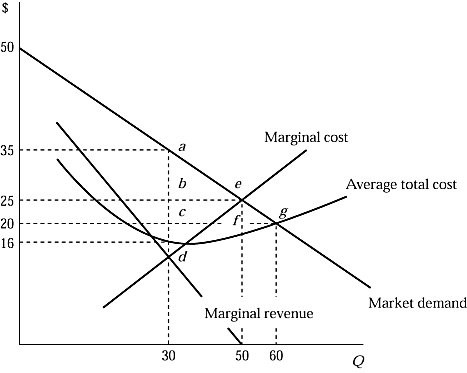

Refer to Figure 7.4. If the market was a monopoly, the consumer surplus would be:

Refer to Figure 7.4. If the market was a monopoly, the consumer surplus would be:

A. $625. B. $450. C. $300 D. $225.

Referring to Figure 18.3, an appreciation of the dollar is represented by a movement from point:

Referring to Figure 18.3, an appreciation of the dollar is represented by a movement from point:

A. a to d. B. c to d. C. a to c. D. b to c.