Unreimbursed medical expenses in excess of 8.5% of AGI are tax deductible.

A. True

B. False

C. Uncertain

B. False

You might also like to view...

A defined benefits plan

A) is always fully funded. B) may be underfunded but cannot be overfunded. C) may be overfunded but cannot be underfunded. D) may be either underfunded or overfunded.

The increasing cost in the law of increasing cost is a(n) ____________ cost.

A. average B. fixed C. opportunity D. declining

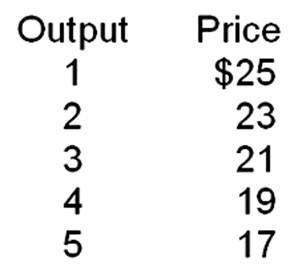

The marginal revenue that would be derived from producing a fifth unit of output is

A. $9.

B. $11.

C. $13.

D. $15.

Suppose both the demand for and supply of salsa increase (although not necessarily by the same amount). What can we conclude about changes in the price and quantity of salsa?

A. Both the price and quantity decrease. B. The quantity increases but the change in the price cannot be determined. C. Both the price and quantity increase. D. The price increases but the change in the quantity cannot be determined.