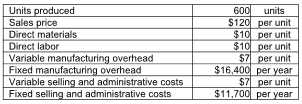

What is the operating income using variable costing if 500 units are sold?

Bethel, Inc. has collected the following data. (There are no beginning inventories.)

A) $14,900

B) $43,000

C) $48,300

D) $11,100

A) $14,900

Sales Revenue $60,000

- Variable Costs* 17,000

Contribution Margin 43,000

- Fixed Costs** 28,100

Operating Income $14,900

![]()

You might also like to view...

Most merchandisers receive checks and currency from customers in two ways: (1) cash received over the counter from cash sales and (2) cash received in the mail from credit sales

a. True b. False Indicate whether the statement is true or false

When attempting to detect terrorists and criminals in public places, officials pay attention to suspects’ ______.

A. cars B. shoes C. body language D. groups

Use the following income statement and information about changes in noncash current assets and liabilities to (1) prepare only the cash flows from operating activities section of the statement of cash flows using the indirect method and (2) compute the company's cash flow on total assets ratio for the year assuming that average total assets are $525,250.Davey CompanyIncome StatementFor Year Ended December 31Sales?$880,000Cost of goods sold? 487,000Gross profit?$393,000Operating expenses:?? Salaries expense$144,000? Rent expense 76,000? Depreciation expense 45,000? Amortization expense 22,000? Utilities expenses 12,000 299,000Income from operations?$ 94,000Loss on sale of equipment? 14,000Income before taxes?$

80,000Income tax expense? 28,500Net Income?$ 51,500Changes in current asset and current liability accounts for the year that relate to operations follow.Increase in accounts receivable$ 32,000Increase in accounts payable (all accounts? payable transactions are for inventory)13,500Decrease in prepaid expenses9,200Decrease in merchandise inventory14,000Decrease in long-term notes payable20,000 What will be an ideal response?

Writing a message with a reading index appropriate to the audience guarantees that the message will be understood

Indicate whether the statement is true or false