When the Fed decreases the money supply, what will happen to nominal interest rates?

What will be an ideal response?

They will rise.

You might also like to view...

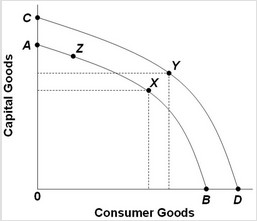

Use the figure below to answer the next question.  Economic growth is best represented by a

Economic growth is best represented by a

A. move from X on AB to Y on CD. B. move from X to Z along AB. C. move from Z to X along AB. D. shift of the production possibilities frontier from CD to AB.

If there is no Ricardo-Barro effect, a government budget surplus ________ the total supply of loanable funds and ________ the real interest rate

A) does not change; does not change B) increases; raises C) increases; lowers D) decreases; lowers E) decreases; raises

In the Harrod-Domar model, if the savings rate is 20% and the incremental capital output ratio is five, abstracting from depreciation, what is the implied growth rate?

What will be an ideal response?

Uncertainty about interest-rate movements and returns is called

A) market potential. B) interest-rate irregularities. C) interest-rate risk. D) financial creativity.