If the elasticity of supply is much greater than the elasticity of demand, an excise tax levied on the suppliers will

a. cause the suppliers to incur a greater burden of the tax than demanders

b. cause the demanders to incur a greater burden of the tax than suppliers

c. the burden of the tax will be shared equally between the suppliers and the demanders

d. cause the entire burden of the tax to rest on the demanders

e. Without more information as to the amount of the excise tax, who will incur a greater burden will be unclear

B

You might also like to view...

Explain the intuition behind why the aggregate demand curve is downward sloping. Why does an increase in the money supply shift the aggregate demand curve to the right?

What will be an ideal response?

When taxes are decreased, disposable income increases even though GDP is unchanged

a. True b. False Indicate whether the statement is true or false

Which statement is true?

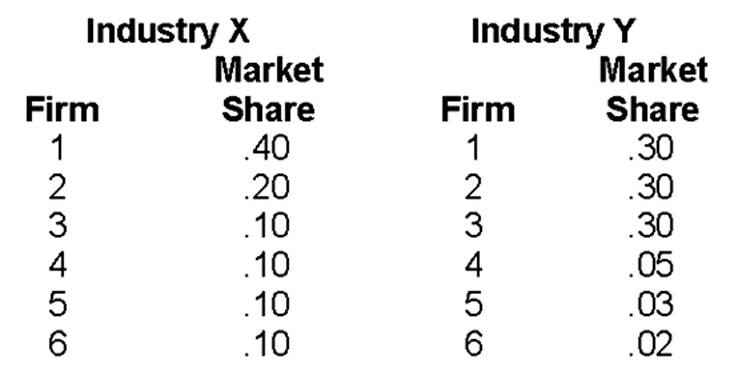

A. Industry X has a Herfindahl-Hirschman Index of 2400.

B. Industry X has an H-H-I of 100.

C. Industry X has an H-H-I of 80.

D. Industry X has an H-H-I of 1,000.

The theory of land rent holds that

A. all plots of land are identical. B. all land yields a positive rent return. C. rent on any piece of land will equal the difference between the cost of producing the output on that land and the cost of producing it on marginal land. D. competition for superior plots of land will force the rent on those lands to a marginal return of zero.