Both presidents Kennedy and Reagan proposed significant cuts in income taxes. Opponents of these tax cut proposals argued that

A) it would be better to cut taxes on corporate profits.

B) cutting state sales taxes, rather than federal income taxes, would result in greater economic efficiency.

C) while the tax cuts would result in greater economic efficiency, there was too much opposition to the tax cuts in Congress. As it turned out, Congress ultimately approved both tax cut proposals.

D) the tax cuts would benefit high-income taxpayers.

D

You might also like to view...

Which of the following items is included in the M1 money supply?

A) $10 bills in the Bank of America B) a $5,000 student loan granted to a U.S. citizen C) coins in a Pepsi vending machine, waiting to be used as change D) a $5,000 line of credit on a newly graduated student's credit card E) $1,500 in a student's saving account

Last year the price of a dozen eggs was $1, and this year the price is $1.30. Which of the following does NOT express this price change accurately?

A) The price increased 30 percent. B) The price increased by 30 cents. C) If last year was the base year, the index number for this year would be 130. D) If this year is the base year, the index number for last year would be 130.

The money supply will grow even larger through deposit creation when

A. People decide to use cash instead of checks for transactions. B. Interest rates rise, causing people to move money out of banks and into bonds. C. Banks stop making new loans because they are too risky. D. Consumers, businesses, and government increasing their borrowing.

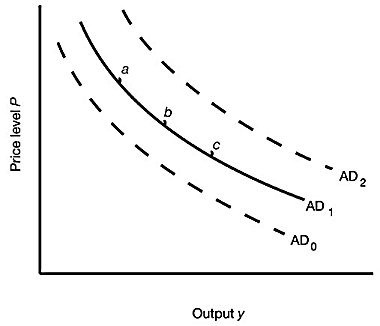

Figure 14.1 shows three aggregate demand curves. A shift from curve AD1 to curve AD0 could be caused by a(n):

Figure 14.1 shows three aggregate demand curves. A shift from curve AD1 to curve AD0 could be caused by a(n):

A. increase in the money supply. B. decrease in taxes. C. increase in the price level. D. decrease in government spending.