Canada produces MP3 players and lumber, and the horizontal axis for Canada's production possibilities frontier represents the amount of lumber produced

Canada's borders are not initially open to trade, and the country consumes along its production possibilities frontier where the MRT and MRS equal the price ratio for the two products ($200 per 1,000 board-feet of lumber versus $100 per MP3 player). If Canada opens its borders to trade with China at world prices for the two goods ($300 per 1,000 board-feet of lumber and $100 per MP3 player), what happens in the Canadian economy? A) Canada will shift consumption along the original production possibilities frontier until MRT equals the world price ratio, and Canadians will consume less lumber and more MP3 players.

B) Canada will shift consumption along the original production possibilities frontier until MRT equals the world price ratio, and Canadians will consume more lumber and less MP3 players.

C) Canada will be able to trade with China, and the gains from trade allow Canada to afford bundles of the two goods that do not lie along the country's production possibilities frontier.

D) Canada may trade with China, but we do not have enough information to determine how the opening of the border will affect the trade decisions.

C

You might also like to view...

The price of coal fell and the quantity sold also fell. Everything else being equal, it is consistent that

A. the price of oil fell. B. coal miners received large wage increases. C. more efficient mining equipment was installed. D. consumer incomes rose. E. the supply of coal fell.

The supply curve of a good is highly elastic when

A) additional resources can be attracted into its production by the prospect of a slightly higher reward. B) its marginal supply cost is highly sensitive to changes in demand. C) marginal cost is very low. D) marginal cost rises steeply as the quantity supplied increases. E) the demand for the good is greater than the supply.

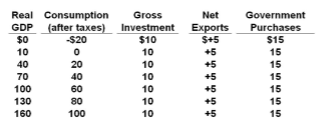

Refer to the table. If the full-employment real GDP is $100, the:

A. inflationary expenditure gap is $30.

B. inflationary expenditure gap is $10.

C. recessionary expenditure gap is $30.

D. recessionary expenditure gap is $10.

Using the CPI, the rate of inflation can be calculated by

A). 100 x [CPI(current year) - CPI(prior year)] B) [CPI(current year) - CPI(prior year)] x CPI(prior year) C) 100 x [CPI(current year) - CPI(prior year] / CPI(prior year) D) CPI (current year) / CPI (prior year)