Paul wins a $500 watch in a sweepstakes and decides to keep it, even though he says he would have preferred to win $500 cash. Knowing Paul's preferences, how can we explain his decision to keep it?

A. Paul has a cognitive bias; he is ignoring a nonmonetary opportunity cost of already owning the watch.

B. Paul has a cognitive bias, and it leads him to value the watch more because he owns it.

C. Paul's implicit cost of ownership makes him feel as though he should keep the watch.

D. All of these are true.

Answer: D

You might also like to view...

Accounting profits at a firm's break-even point are

A) positive. B) negative. C) zero. D) indeterminate since we need to know what demand is.

The forward exchange rate:

a. allows investors to be sure of the price at which they can trade forex in the future. b. is the rate at which a trader can purchase currency for immediate delivery. c. is the rate of discount that international banks get when they purchase. d. is the rate that speculators consider if they are looking for bargain prices .

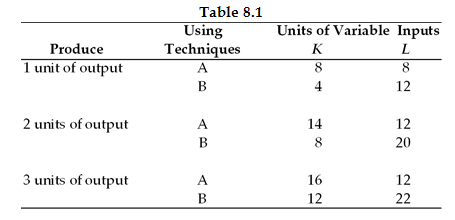

Refer to Table 8.1. Assume that the relevant time period is the short run. Assuming the price of labor (L) is $5 per unit and the price of capital (K) is $10 per unit, this firm's total cost of producing one unit of output is A) $100. B) \$120. C) $220. D) indeterminate from this information.

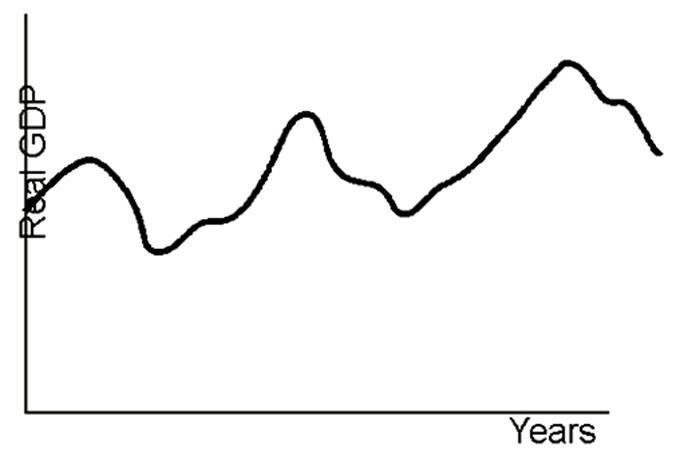

Label the graph above with respect to the three phases of the business cycle and the cycle turning points.