Which of the following is likely to have the smallest price elasticity of demand?

A) an automobile

B) a new automobile

C) a new Ford automobile

D) a new Ford Mustang

A

You might also like to view...

In which of the following situations would a positive externality most likely be involved?

A. Shawn is sitting at home one day when she gets a telephone call, informing her that she has won $10,000 in a contest she entered three months ago. B. There are eight houses in the neighborhood where Rodney lives. Rodney likes nice-looking yards, and last week his neighbors began to beautify their yards. C. Willy needs eight hours of sleep each night to feel good. Last night he got eight hours of sleep. D. Patrick received an A on a biology exam. He is feeling better about his chances of getting admitted to medical school.

Suppose that for every $1 increase in autonomous investment, real GDP demanded rises by $5. Which of the following must be true?

a. The line of aggregate expenditure exactly matches the line of equilibrium. b. Noninvestment expenditures increase with every increase in investment spending. c. The point of equilibrium will decrease with every increase. d. The slope of the aggregate expenditure curve is 5.

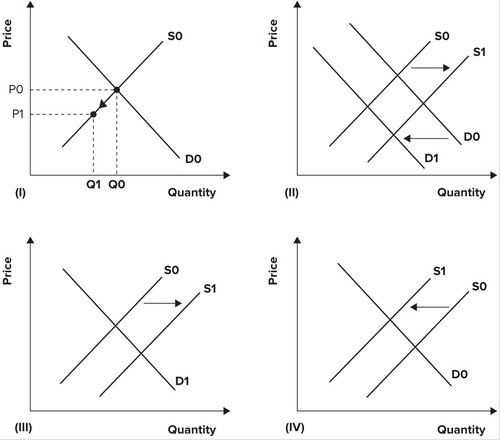

Refer to the following graphs. Floods in the U.S. Midwest reduce the U.S. corn crop. Which graph depicts the effect of the floods on the U.S. corn market?

Floods in the U.S. Midwest reduce the U.S. corn crop. Which graph depicts the effect of the floods on the U.S. corn market?

A. I B. II C. III D. IV

Suppose the income tax rate schedule is 0 percent on the first $10,000; 10 percent on the next $20,000; 20 percent on the next $20,000; 30 percent on the next $20,000; and 40 percent on any income over $70,000. Family A earns $28,000 a year and Family B earns $65,000 a year. Both receive a ten percent raise. What is the marginal tax rate of each and what is the extra tax paid by each after the raise?

A. Family A: 20 percent marginal tax rate and $360 in extra taxes; Family B-40 percent marginal tax rate and $2100 in extra taxes. B. Family A: 10 percent marginal tax rate and $280 in extra taxes; Family B-30 percent marginal tax rate and $1950 in extra taxes. C. Family A: 10 percent marginal tax rate and $420 in extra taxes; Family B-30 percent marginal tax rate and $2275 in extra taxes. D. Family A: 20 percent marginal tax rate and $560 in extra taxes. Family B-40 percent marginal tax rate and $2600 in extra taxes.