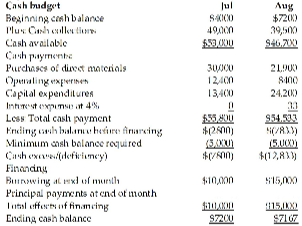

The cash balance on June 30 is projected to be $4000. The company has to maintain a minimum cash balance of $5,000 and is authorized to borrow at the end of each month to make up any shortfalls. It may borrow in increments of $5,000 and has to pay interest every month at an annual rate of 4%. All financing transactions are assumed to take place at the end of the month. The loan balance should be repaid in increments of $5,000 whenever there is surplus cash. Calculate the ending projected cash balance before financing for August.

Carol's Chocolate Company has prepared its third quarter budget and provided the following data:

A) $7167

B) $5,000

C) $46,700

D) $(7833)

D) $(7833)

You might also like to view...

Pipelines make up a very specialized mode that services only a few industries.

Answer the following statement true (T) or false (F)

Execution of a deed by a grantor and placement in the grantor's safe deposit box is sufficient for delivery

Indicate whether the statement is true or false

An investor gains from short selling by ________ and then later ________

A) buying a stock; selling it at a higher price B) selling a stock; buying it back at a lower price C) buying a stock; selling it at a lower price D) selling a stock; buying it back at a higher price

Direct materials are not easily traced to a product.

Answer the following statement true (T) or false (F)