In what type of analysis could an increase in the tax rate lead to a decrease in tax revenues?

A) ad valorem taxation

B) excise taxation

C) dynamic tax analysis

D) static tax analysis

Answer: C

You might also like to view...

At the point at which the consumption function intersects the 45 degree reference line

A) planned real consumption of real disposable income equals zero. B) planned real saving equals real disposable income. C) planned real consumption equals real disposable income. D) equilibrium output is supply determined equilibrium output is determined by both.

Total profit is maximized where

A. MR = MC. B. marginal profit is zero. C. the slope of the marginal profit curve is zero. D. All of the responses are correct.

If businesses in general decide that they have overbuilt and so now have too much capital, their response to this would initially shift

a. aggregate demand right. b. aggregate demand left. c. aggregate supply right. d. aggregate supply left.

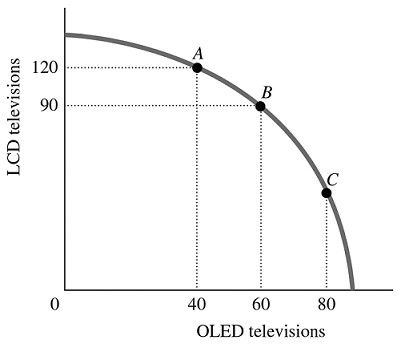

Refer to the information provided in Figure 2.5 below to answer the question(s) that follow. Figure 2.5Refer to Figure 2.5. The marginal rate of transformation in moving from Point B to Point A is

Figure 2.5Refer to Figure 2.5. The marginal rate of transformation in moving from Point B to Point A is

A. -2/3. B. -3/4. C. -1.5. D. -20.